July 3rd, 2024Real estate market state of play in Highlands

Words: Kyle Barnes

Vendors’ expectations need to be adjusted with a drop in property prices after the panic buying and selling of the pandemic.

That’s the view of Central Highlands buyers’ advocates Kathy Hodge and Max Waller. Journalist Kyle Barnes talked to Kathy and Max, along with local real estate agents, about the current state of play in the real estate market.

Infolio Property Advisors buyers’ agent Kathy Hodge represents buyers from Melbourne and those who live abroad, and has bought properties for several clients who have lived overseas and are relocating back to Australia after a considerable time.

Kathy said there was possibly an oversupply of overpriced properties and there was still a lot of vendor resistance to meeting the market expectations.

“Properties’ days on market are blowing out compared to Covid times where things moved pretty quickly. Having said that though, I think well-priced, well-presented properties are still selling well.

“The biggest hurdle now is pricing and vendor expectations are a little unrealistic. Anecdotally some properties are on the market for six months without a price adjustment. But good, well-priced properties might be selling in three to four weeks.”

Asked if there was a set percentage drop needed, Kathy disagrees.

“I don’t think there is a set percentage. Sometimes, for example, if a property was priced at $1.5 to $1.55 million you might want to adjust it to under $1.5 million. So, you might adjust it to $1.45 to $1.48 million, something like that.

“Often it’s that psychological barrier of the next increment. Also, if people put a range from $1 million to $1.5 million into their search engines they might not capture a property that is just out of that range.”

Max Waller, CEO of Provincial Group, a property advocacy and finance broking company, talks through some figures to better clarify the market position.

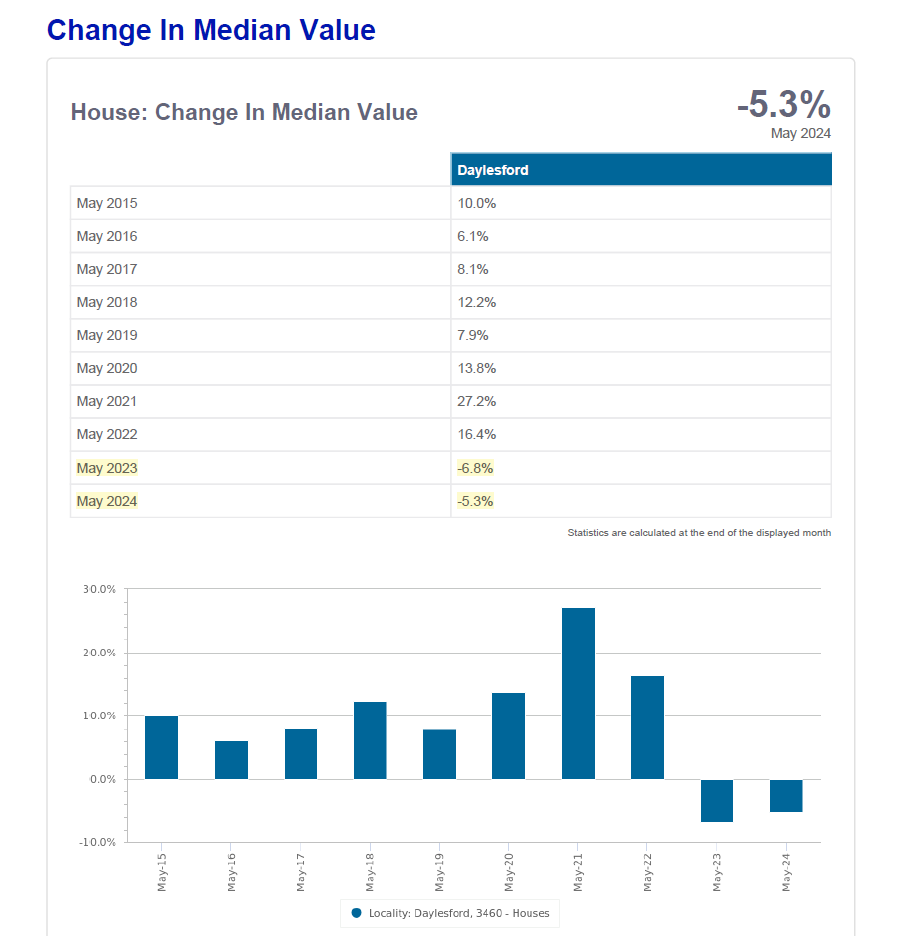

“Firstly, the market is down by 5.3 per cent from May 2023 to May 2024, but we must remember that we were down 6.8 per cent already on the May 2022 to May 2023, so the market had already started its decline.

“But coming off May 2021 to May 2022, where we had gained 16.4 per cent, you can see if you date it back through the years it’s been really strong in 2020–2021 which is obviously because of Covid.

“So now we are starting to see a collective and compounding drop of circa 11–12 per cent of the value since May 2022. And then there is the more important bit to the relevance to the current state of the market and that is the supply.

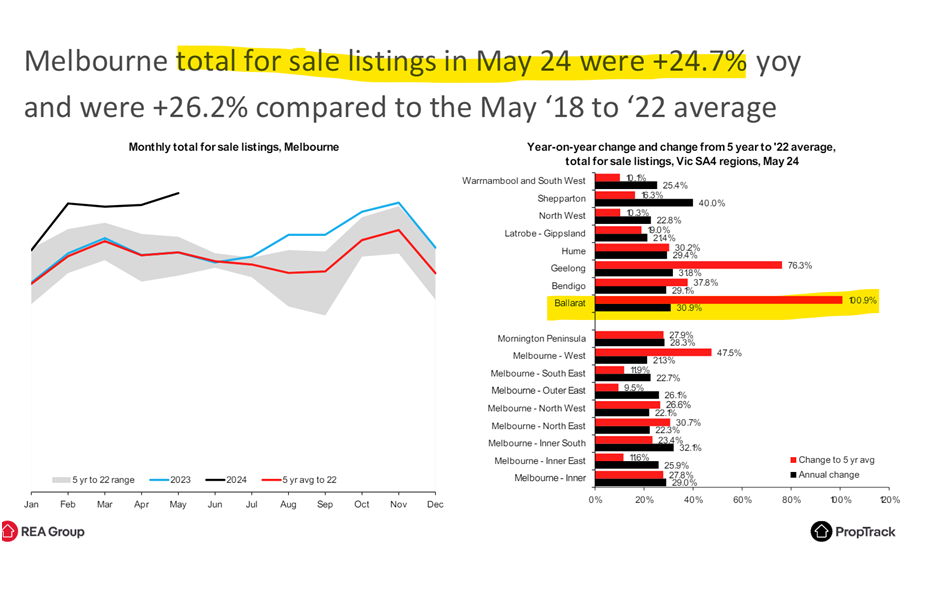

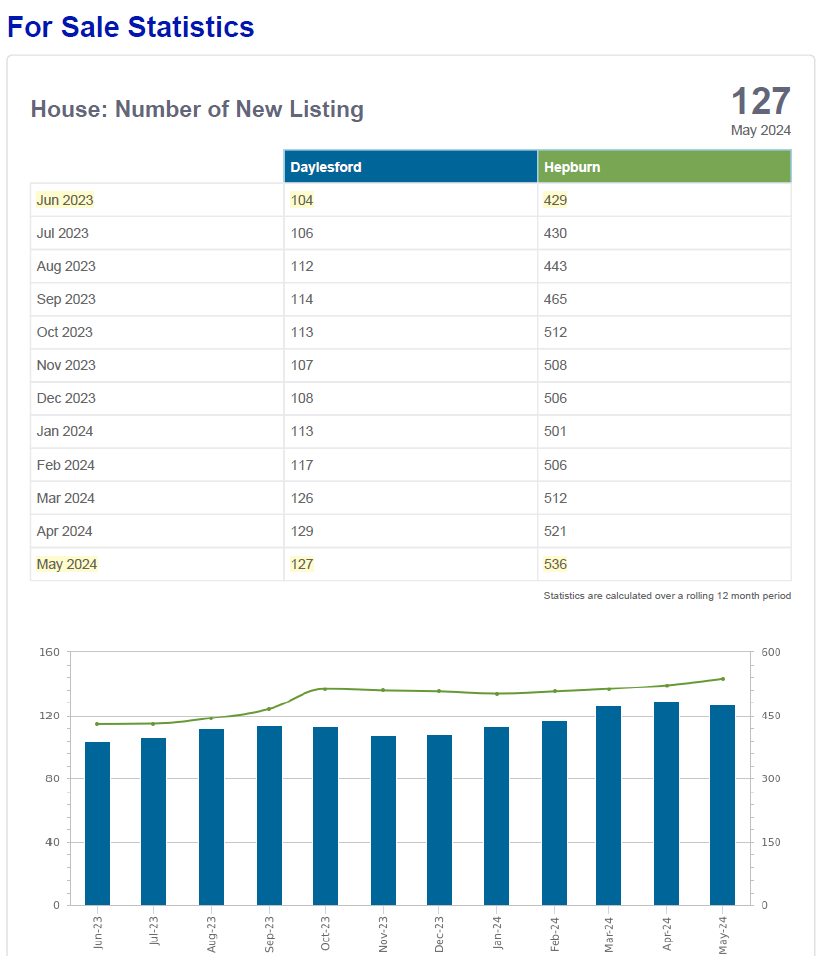

“(If you) have a look at June ’23 versus May ’24, and for a population that is the size of the Daylesford and Hepburn area, we are talking about over 100 extra properties on the market than we had 12 months ago.

“So, with the old law of supply and demand, and how the market reacts to this message, there is a consistent message across the market about stock supply, and because it’s not selling it’s accumulating.”

Max said in terms of a vendor wanting to sell their property they should first and foremost understand what the market is doing right now before venturing into it.

Vendors needed to be really prepared to understand the market, their competition, its pricing, how long properties have been on the market and how many properties are for sale in comparable form. This will help make better decisions in relationship to two things, Max says.

“Firstly, how will I appropriately price this property to get a result and secondly, is it the right time to sell my property or should I be reconsidering? There are two measures in this decision – the market and the individual’s personal situation.

“The data will show people very clearly what they would have got in May 2022 is not what they’re going to get now. There has been a very clear shift of 11–12 per cent. The gloss on this, and the exception to the rule, is the unique property market.

“When unique properties come up from time to time, because they are rare and in short supply, they do tend to get the asking price.

“For them it doesn’t matter what the market is doing, those properties are special, and they will be received and perceived as special by the buyers in the market.”

Jellis Craig Daylesford’s senior sales consultant Gary Cooke said they had been seeing a steady rebound in the market with the number of buyers looking and enquiring online and attending open houses in May and June.

“These numbers have been significantly higher than what we saw in the first four months of the year.

“This has resulted in stronger sales in both May and June. Previously we saw a very large amount of stock on the market, and a small number of buyers.

“The balance of available stock and available buyers seems to be levelling out, returning to a more consistent market.”

Gary said vendors often asked if they should hold until spring and avoid the winter period but said there was no reason to wait if properties were correctly priced, with potential owners aware they were buying in a region with a real winter season.

“We live in a cold climate area, and we are used to selling in the cold climate. Depending on the property, I would suggest there would be no reason to hold off listing, now that we are seeing a more consistent market, which we are predicting will continue to keep improving.

“There have been price corrections since Covid and it’s clear properties priced correctly are getting sales activity.”

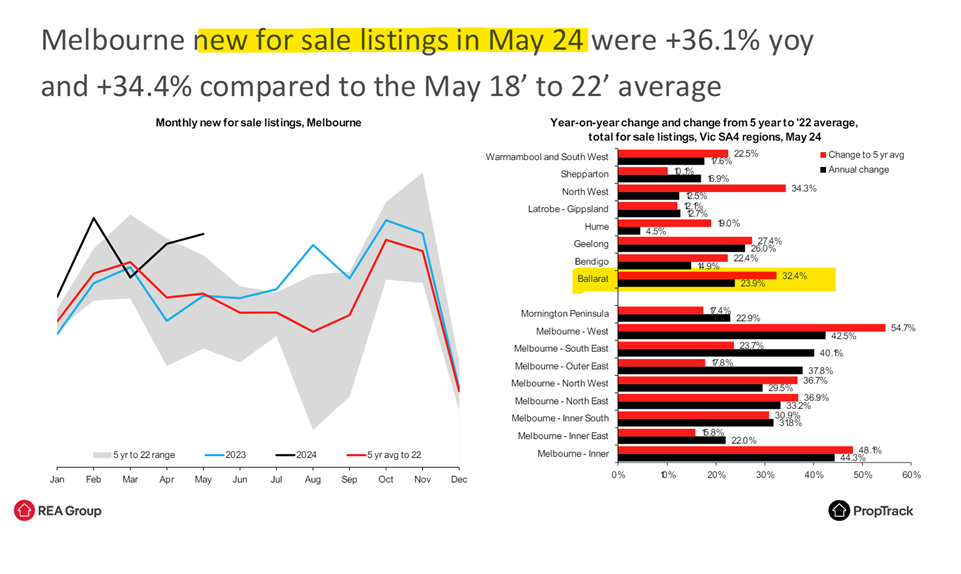

Belle Property Daylesford’s principal director Will Walton said currently regional Victoria was in a correction phase after experiencing unforeseen rapid growth during Covid. Compounding this is the worldwide economic slow down.

“Traditionally most buyers in our region were purchasing a second home to enjoy, however now managing the mortgage of the principal home elsewhere may create a challenge for the traditional purchaser to consider a regional purchase.

“It’s important for potential vendors to look at what sale prices are being achieved versus listing prices. A property correctly priced (and) marketed widely combined with exceptional presentation will always perform best in achieving a great result.

Everyone wants to believe their property is the best, however listening to an agent’s opinion on comparable sales is important in considering an independent view.”

McQueen Real Estate director Kim McQueen said the current property climate in the region is one of the toughest she can remember and “we have never worked harder with buyers to get deals done”.

“There are a combination of factors affecting our market – high interest rates and the cost of living crisis, land tax increases and the looming Vacant Residential Land Tax and other costs deterring buyers from entering the investment and holiday home market and soaring building costs affecting land sales.”

Kim said increasing stock levels combined with a decrease in buyer activity had culminated in sluggish mid-year transactions.

“There has been a sharp price correction particularly over the past six months with the heady Covid prices a distant memory. This has led to some good recent results with May being an exceptional month for McQueen Real Estate.

“But it was a culmination of many months of hard work to get buyers to the table and have them transact. May included some record sales for the region and for McQueen Real Estate with the highest price paid for a home within the Trentham township of $2.5m and a $4 million plus sale in Porcupine Ridge.

“Well-presented properties that are realistically priced with patient vendors will succeed in this market.”

Kim said whether a property should wait until spring depended on the property.

“Winter in our region can be beautiful and homes with roaring log fires and cosy interiors can present beautifully. But properties with stunning gardens may present better in spring.

“When will the market pick up? I think as soon as we get news of an interest rate decrease the buyers will be back in larger numbers. The desire to move to our beautiful region is still strong.”

“The real estate market has been on a rollercoaster ride over the past few years, with Covid-19 significantly impacting buyer and seller behaviours. As the pandemic wanes, the market is shifting, offering both challenges and opportunities.”

BigginScott Daylesford director Tom Shaw said amid ongoing reports of the RBA keeping interest rates steady since November 2023, June witnessed a 12-month record in sales, especially in the Creswick area, which has been a hot spot for buyers.

Good quality stock has fuelled strong buyer activity, resulting in some buyers missing out, he said.

“Currently, the market remains vibrant, driven by cautious optimism and pent-up demand. Many homeowners are debating whether to wait until spring to sell their properties. Traditionally, spring is the prime selling season, but given the current conditions, waiting might not yield better results.

“Firstly, Daylesford is experiencing a correction from the inflated prices seen during the pandemic. Buyers are more discerning, and the bidding war frenzy has subdued, creating a balanced market. Realistically priced and well-marketed properties can still attract strong interest and competitive offers.

“Secondly, waiting until spring could mean more competition, as many sellers might have the same idea. Listing now could give sellers an edge. With interest rates remaining low, buyers are still motivated, and current inventory levels are manageable, creating a favourable environment for sellers.

“Prices have adjusted from their pandemic peaks but remain strong. Realistic pricing can still yield good returns. The appeal of moving to more spacious, less densely populated areas like Daylesford remains strong, with many still looking to this region for relocation.

“While spring remains a popular time to sell, the current conditions in Daylesford suggest that selling now can be equally advantageous.”