January 16th, 2025Real estate trends impacting local market

A range of taxes are impacting property sales in regional Victoria, real estate agents say. Among them, Belle Property’s Will Walton lists four taxes that he identifies as making buying in regional Victoria a challenge.

“The four taxes making buying a challenge are land tax, vacant land tax (a wealth tax by default), the B&B levy and the fire levy increase,” he says.

“These state government imposed costs are compounding our market difficulties especially as we so heavily rely on tourism for our local economy and employment, including accommodation to house tourists.

“The ratio of one buyer for every five homes is now one in 10 homes. Every property is competing with each other.”

Agent Kim McQueen of McQueen Real Estate says certain sectors of the market, especially the holiday-let segment, are being heavily impacted while other sectors – notably the higher-end segment in which her agency specialises – are flourishing.

“We tend to specialise in slightly more high-end properties and we’ve had an amazing end of ‘24 with very strong sales at the top of the range,” Ms McQueen said.

“Over late November to December we’ve sold more than $13 million in property. The really good, exceptional properties will sell well in any market and our region is blessed to have many of these properties.

“In our region we have a lot of subsets in the market, and the area that’s being mainly hit is the holiday-let investor stock. The reason is all the taxes. “Taxes have skyrocketed.”

In the holiday-let investor segment, in particular over the past 18 months, it’s been a “very tough market,” Ms McQueen says.

“That’s the one that has just been decimated. Investors used to be 50 per cent of our buyers. We now have very few investors. It’s Victoria-wide.”

Some observers now believe ditching Victoria’s big taxing approach should be a top priority in the government’s regional housing supply inquiry, while others believe the tax measures are needed to tackle the wider housing affordability crisis.

In regional towns, including those in the Hepburn Shire, many houses are sitting vacant, their absentee owners rarely visiting, while countless Victorians struggle to put any roof over their heads at all.

Over the past couple of years the Victorian government has brought in some new and expanded property taxes. In regional areas the most substantial have been the expansion of land tax, bringing Melbourne’s vacant land tax to the rest of Victoria, and the short- stay accommodation levy.

Early last year the state government introduced sweeping changes to land tax, lowering the tax-free threshold for general land tax rates from $300,000 to $50,000 for those who hold a second property.

Asked her opinion on whether the taxation measures may be going some way toward tackling the housing affordability crisis (by disincentivising additional property acquisition as investment), Ms McQueen says the broader picture is a complicated one.

“It is very complicated. People that own holiday homes in our region are generally average normal people who have saved a very long time to purchase an investment property so they can be self-funded retirees and not be reliant on the government.”

Meanwhile some analysts, like economist Alan Kohler in his recent book The Great Divide: Australia’s Housing Mess And How to Fix It interrogates the underlying notion of using housing as a vehicle for wealth-creation.

“It will be impossible to return the price of housing to something less destructive – preferably to what it was when my parents and I bought our first houses – without purging the idea that housing is a means to create wealth as opposed to simply a place to live,” Kohler states in the book.

Like Mr Walton, Ms McQueen believes the taxation measures, that agents say are particularly impacting the holiday-let investment end of the market, are having a damaging flow-on impact on tourism.

But despite the impacts of the taxation measures, Mr Walton remains optimistic about the year ahead.

“Belle Property has had a record month. The Daylesford office team has successfully sold 12 properties, four more than average per month.”

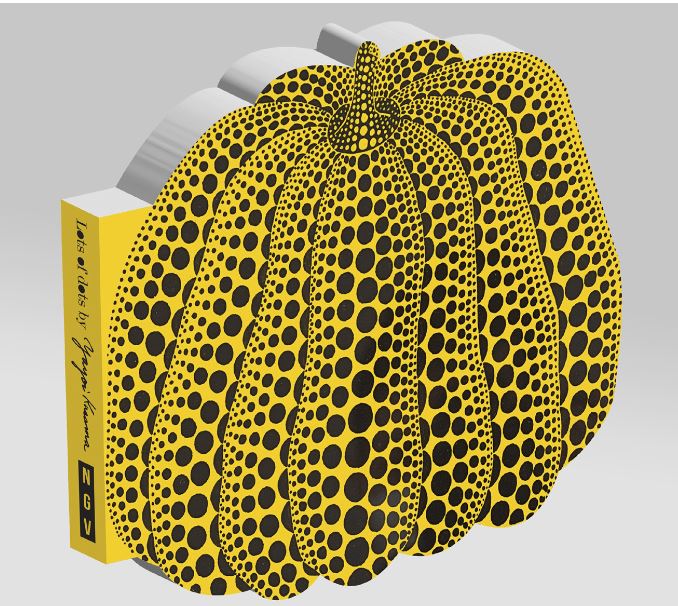

Words: Eve Lamb | Image: Kyle Barnes