April 24th, 2024Tougher times impacting property sales

The cost of living is cutting into demand for property locally and further afield, the latest real estate trends indicate.

“There are a very high number of properties on the market with properties taking between four to six months to sell,” Belle Property Director Will Walton says.

“After COVID there were five buyers for every property. Now it’s the reverse.”

CoreLogic’s national Home Value Index shows that nationally property prices continue to rise, but that prices in regional Victoria have gone against the trend and declined by 0.3 per cent in the first quarter of 2024.

According to Mr Walton, properties that are realistically priced are still selling locally and there are signs of renewed interest heading towards May. Locally about half of houses are now selling above $890,000 and half below, local real estate agents report.

Renovated three bedroom, two bathroom properties on a good size block go for between $1.2 and $1.5 million.

Most economic commentators expect interest rates to remain stable during 2024 and it’s forecast that inflation will slowly decline to below three per cent heading into 2025.

In the medium term it is expected that average mortgage interest rates will fall to between five and six per cent.

Nationally, the shortage of housing remains the major reason for high property prices and rents.

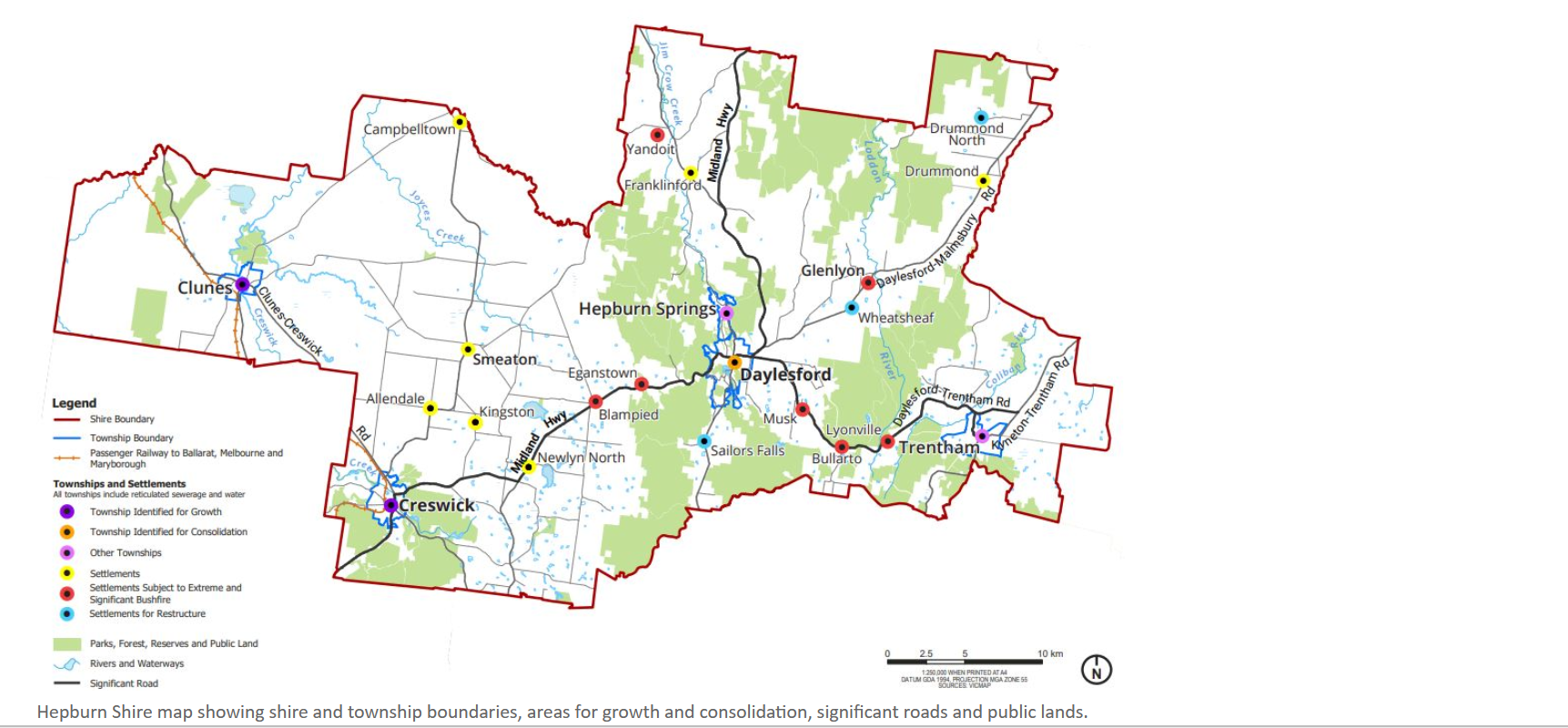

The impact on local property prices is expected to be influenced by factors, including the supply of properties, the trend toward flexible work, government regulations on short term accommodation and tax policies.

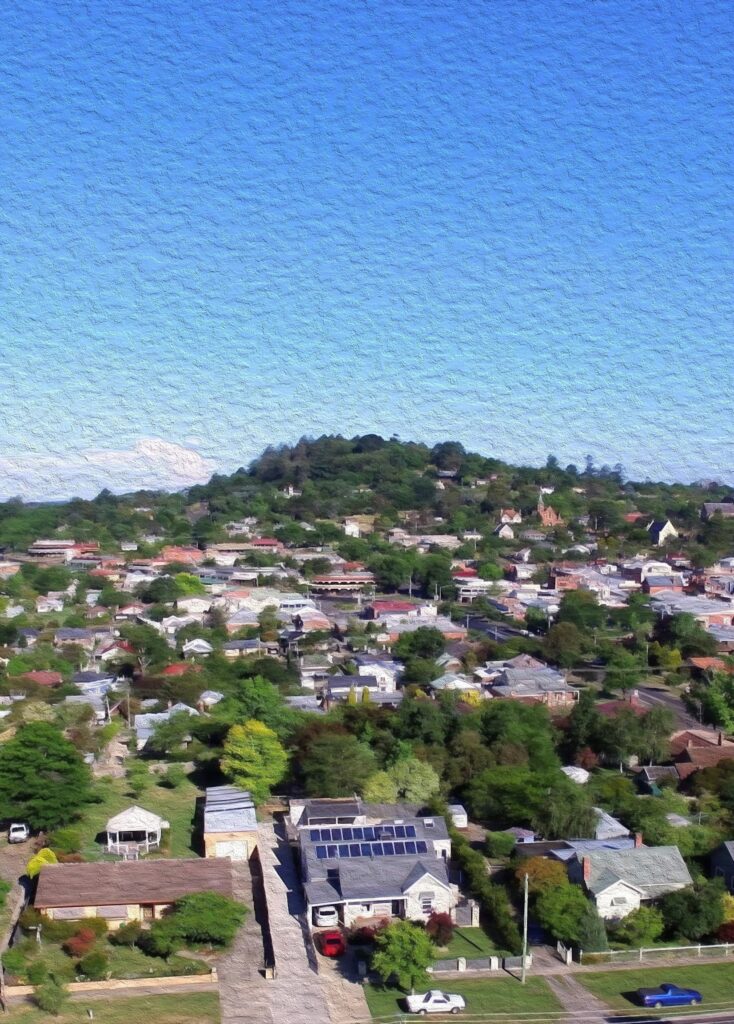

And while times are tougher at the moment, Daylesford and Hepburn Springs remain attractive destinations for visitors and residents and it is likely that demand will continue to be robust over the medium term.